Getting a Last Will and Testament in 2018

One of the most foundational documents from an estate planning perspective is the last will and testament. Whether you are 25 with no kids or 65 with grandchildren, a will is a good estate vehicle to have. A will is simply a legal document that expresses what your last wishes are, who should receive your property after your death, who should be your children’s guardian, and what should happen with your personal property.

Who should create the will?

I cannot stress this enough: have an estate planning/trust lawyer draft your will. There are many nuances when it comes to drafting a will and performing the will ceremony. Simply writing your wishes on a piece of paper and getting it notarized will never hold up in court if someone ever decides to challenge your “will”. Most courts will refuse to file a will that fails to adhere to state formalities, even if there is no chance of a will challenge.

I would even go so far as to say to not trust a general practice attorney or a non-estate attorney to prepare your will. When you’ve sat through several will contest depositions, you quickly learn first hand as to all the ways a will can be challenged. Most general practitioner lawyers never get the opportunity to sit through several hours of questioning about the ceremony of the will.

As a quick example, during one of my depositions, the attorney contesting the legitimacy of one of my wills asked me at what point did I staple the will, before or after I made copies of the document? Was it stapled in front of the two witnesses or in the privacy of my office? You want an attorney who will put great care into every aspect of a will ceremony. Most people presume an event as minuscule as stapling a will has no bearing. They are dead wrong. Even knowing how and when to staple a last will and testament properly comes with experience. To bring the point home, get an estate lawyer to make you your will.

What is the cost?

Not too long ago I was in the market for a new coffee table. Like most people, I thought this may be a good area to save money on by undertaking a Do-It-Yourself project or purchasing a less expensive coffee table. The project resulted in a disaster, and the latter option resulted in dissatisfaction. I finally mustered up enough common sense and spent what needed to be spent in order to get exactly what I wanted. Same principles apply to estate planning documentation. If you want something done right, hire a professional and be prepared to pay.

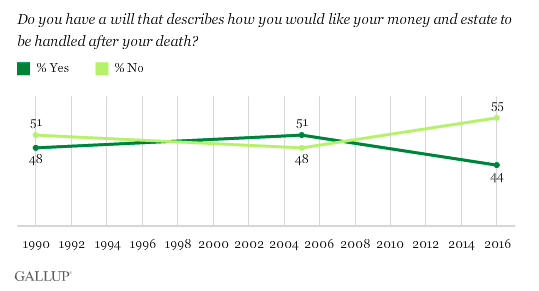

Do not cheap out on your will. Use websites like Avvo to find a lawyer. Legal fees in the range of $600-$1000 for a will is reasonable. Do not let price put you in the category of 55% of Americans who don’t have a will according to a recent Gallup Poll.

What are the benefits?

The underlying purpose of a will is asserting control and attaining a peace of mind. You have control over who gets your wealth, what should take place with your belongings, if all of your children get an equal stake in your estate or if some get a higher share over the others. You have the final say, not the government.

You also choose your executor. An executor of a will is someone who oversees your final wishes and makes sure your beneficiaries get their distribution. If you want to be cremated and have your ashes spread over Mount Fuji in Japan, your executor will probably be the one to do it. Whether he or she does it is another question, considering how impractical your request is. But you get the point. A will nominates someone to manage your estate and fulfill your requests.

Additionally, if you don’t have a will, your estate is doomed to the laws of intestacy. If there are no surviving members in your family, your estate may be liquidated with all proceeds escheated to New York State. Unless you enjoyed paying taxes for the entirety of your life and constantly giving up a portion of your wealth to the State of New York, getting a will may be your only option to avoid that last suck from the financial bureaucratic agency.

What is the downside?

The only downside to a will is the probate process. Without a will, your estate will have to be administered- which is a more lengthier and burdensome process than probate. Creating an irrevocable or revocable trust is an alternative to a will. Assets transferred into a trust do not have to be submitted to the court for approval. The trustee of the trust simply transfers the deed or title to the property to the beneficiaries without involving the court.

Probate becomes an issue when the will is faulty, co-executors cannot get along, someone decides to challenge the will, the executor misappropriates funds or fails to act in the best interests of the estate.

If you want to completely avoid the probate process, a trust could be an option for you. In case you are not familiar with what the probate process entails, here is a good article explaining the probate process.

What to do if I want a will?

If you are ready to make a will, figure out who the guardian of your children should be and express your wishes to this person in advance. Take note of your assets (real estate, bank accounts, stocks & bonds, IRA, etc) and decide who should inherit your property. Make sure to choose a trustworthy individual to be the executor of your estate. Once you have all of that down, find an estate and probate lawyer near you.

Contact us

Should you have any estate or probate questions, feel free to contact us at 646-233-0826. You can also email us directly at Kamilla@Mishiyevalaw.com. We are located in Downtown Manhattan and service Brooklyn, Queens, Manhattan, Staten Island, Bronx, and certain areas of Long Island.